Stop Wasting Time with Manual Invoicing

How FocusOne Can Help You

Generate and send invoices automatically based on sales orders, recurring billing schedules, or service agreements. Customize invoice templates to match your brand and set up automated email dispatch to customers.

Monitor incoming payments in real-time, providing a clear viewof your cash flow. Record partial and full payments, apply them to corresponding invoices, and maintain an up-to-date account balance for each customer.

This feature helps in maintaining accurate financial records and improves financial transparency

Analyze outstanding receivables using detailed aging reports. Categorize overdue invoices by age brackets (e.g., 30, 60, 90 days) to prioritize collections and assess credit risk. This feature helps you identify slow-paying customers and take proactive measures to improve collections.

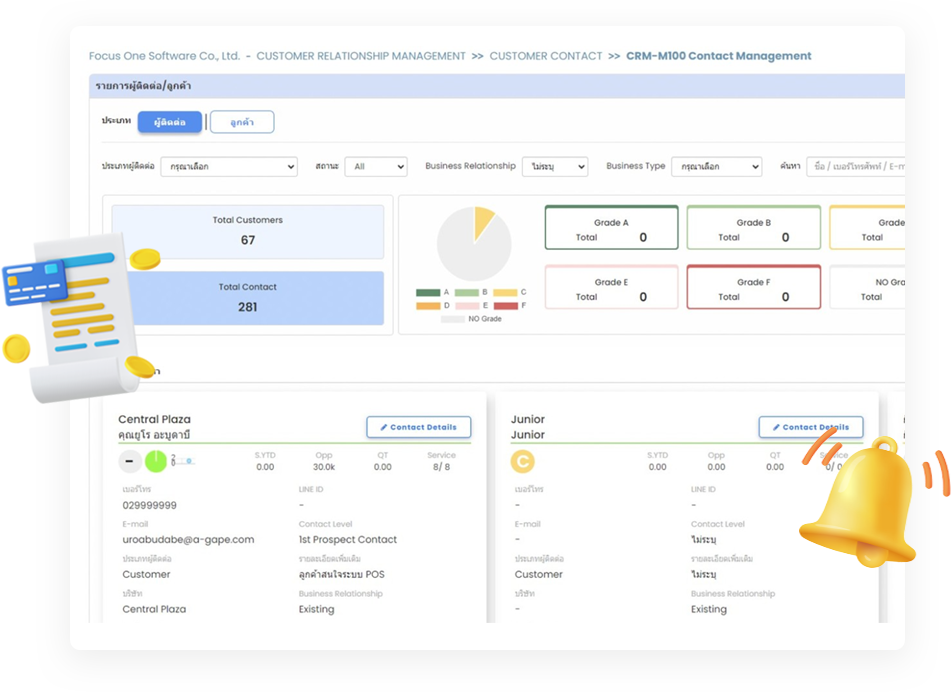

1. Comprehensive Transaction Summaries

Include detailed breakdowns of all transactions related to a customer's account, ensuring clarity and accuracy.

2. Transparent Account Status Updates

Keep customers informed about their current financial standing by outlining outstanding invoices, balances due, and payment statuses.

3. Customizable Format Options

Tailor statement formats to meet diverse customer preferences, accommodating variations in layout, language, and delivery methods.

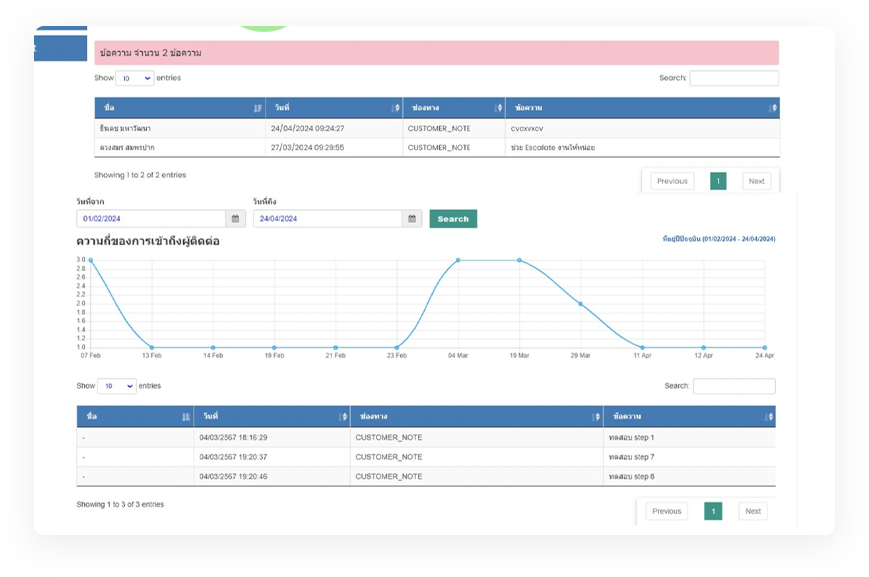

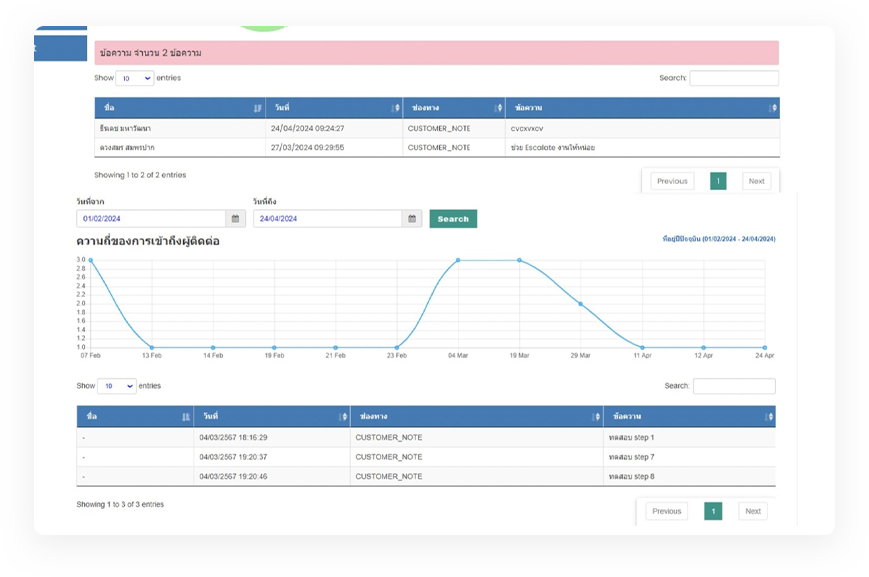

Streamline your accounts receivable process with automated payment reminders. By scheduling reminders for overdue invoices, you can encourage prompt payments without the need for manual follow-up. Customize reminder messages and frequency to suit your customer communication strategy, ensuring gentle yet effective nudges towards settling outstanding balances.

Track the history and responses to reminders to refine your approach and improve overall collection efficiency. Integrated links and instructions simplify the payment process, enhancing customer convenience and reducing the burden on your finance team.

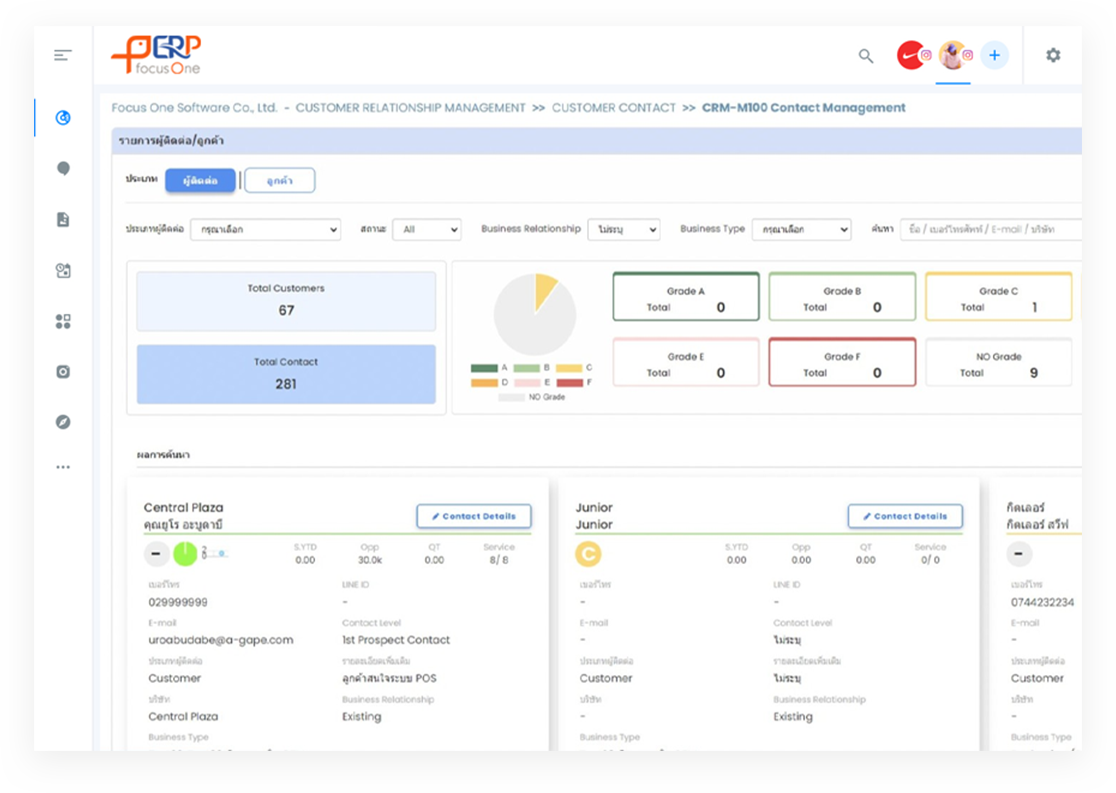

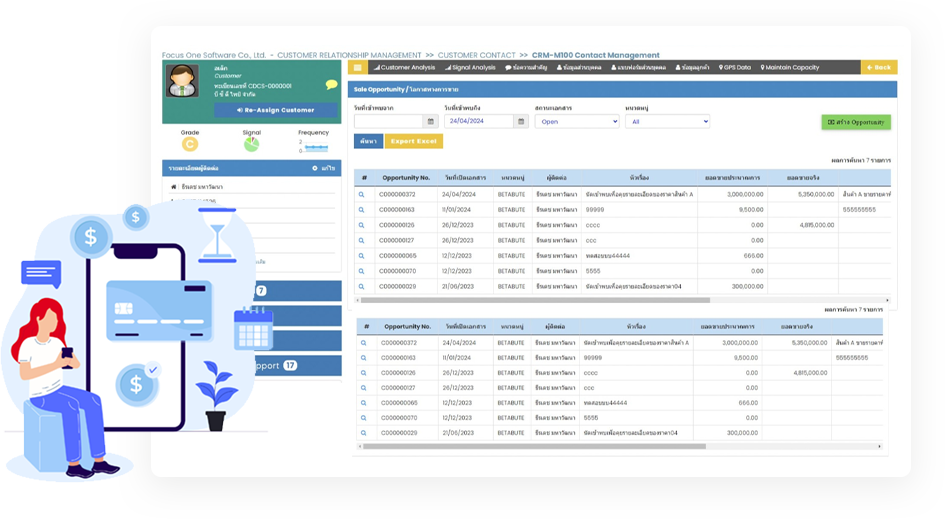

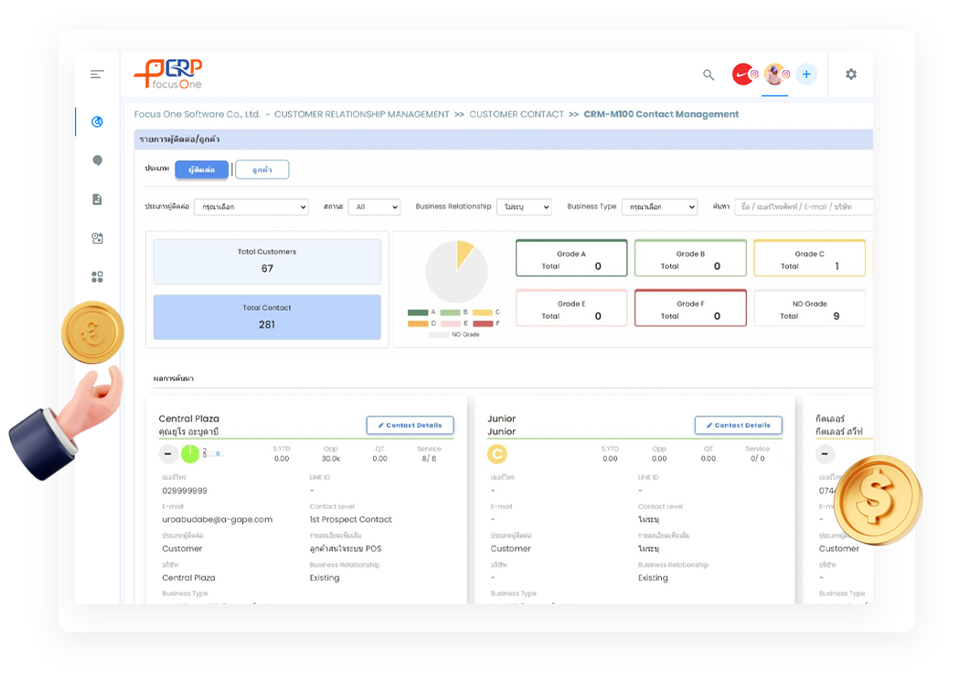

Implement advanced credit risk management tools to evaluate and mitigate potential risks associated with customer credit. This feature integrates credit scoring models and real-time financial data to assess the creditworthiness of new and existing customers.

By setting customizable credit limits and alerts, businesses can proactively manage credit exposure, reduce bad debts, and maintain healthy cash flow. The system also generates comprehensive reports on credit risk analysis, providing actionable insights for decision-makers.

Analyze outstanding receivables using detailed aging reports. Categorize overdue invoices by age brackets (e.g., 30, 60, 90 days) to prioritize collections and assess credit risk. This feature helps you identify slow-paying customers and take proactive measures to improve collections.

Implement advanced credit risk management tools to evaluate and mitigate potential risks associated with customer credit. This feature integrates credit scoring models and real-time financial data to assess the creditworthiness of new and existing customers.

By setting customizable credit limits and alerts, businesses can proactively manage credit exposure, reduce bad debts, and maintain healthy cash flow. The system also generates comprehensive reports on credit risk analysis, providing actionable insights for decision-makers.